Can you explain me more about that Refundable in tax computation

what is the Refundable in tax computation

sadaru Asked on Sep 18, 2025 05:26what is the Refundable in tax computation

sadaru Asked on Sep 18, 2025 05:26Is foreign exchange (forex) income taxable in Sri Lanka?

sanjula Asked on Sep 16, 2025 11:39What is the difference between a Personal Tax File (Foreign + Local Income) and an IT Freelancer/Independent Service Provider Tax File (Foreign + Local Income)?

Yass Asked on Sep 05, 2025 00:50Can someone say registration process of IRD

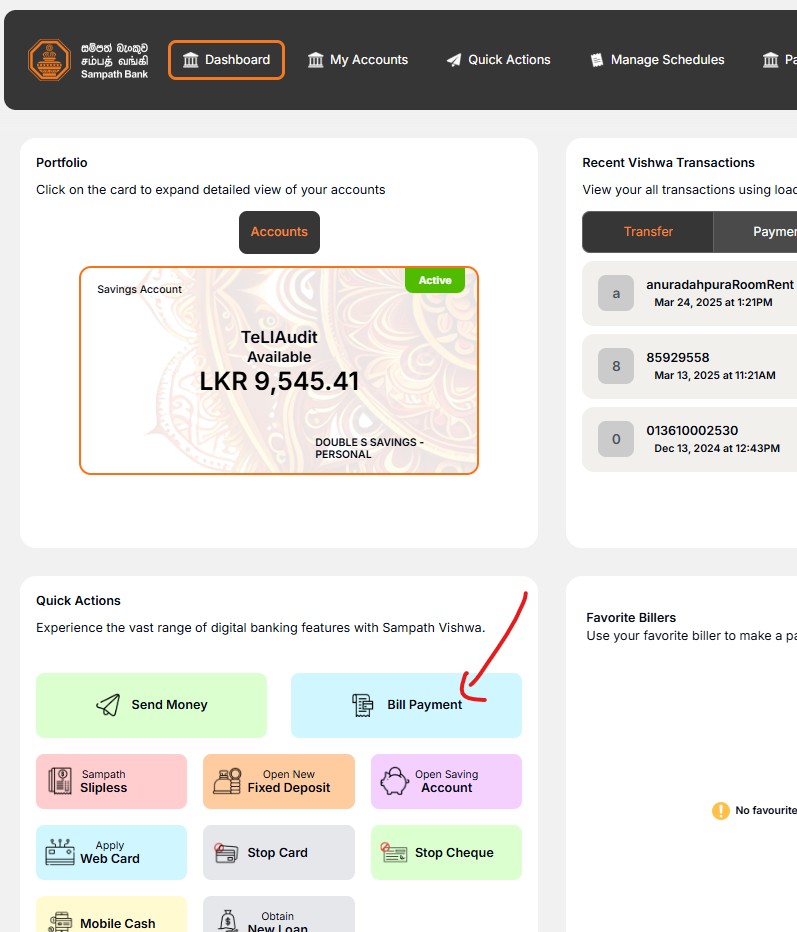

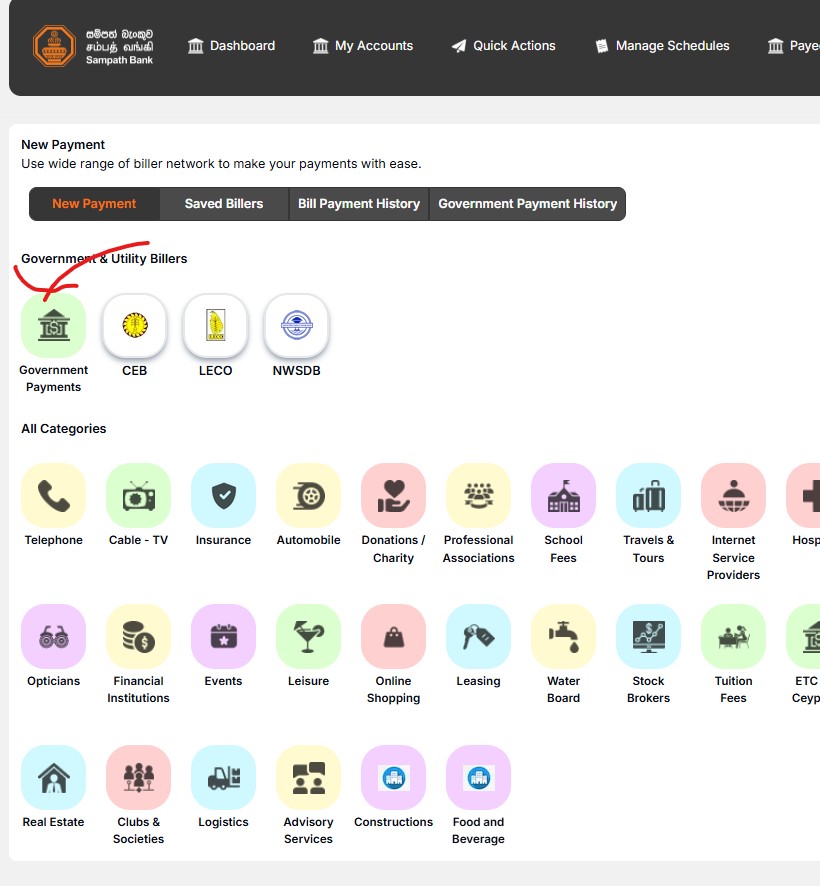

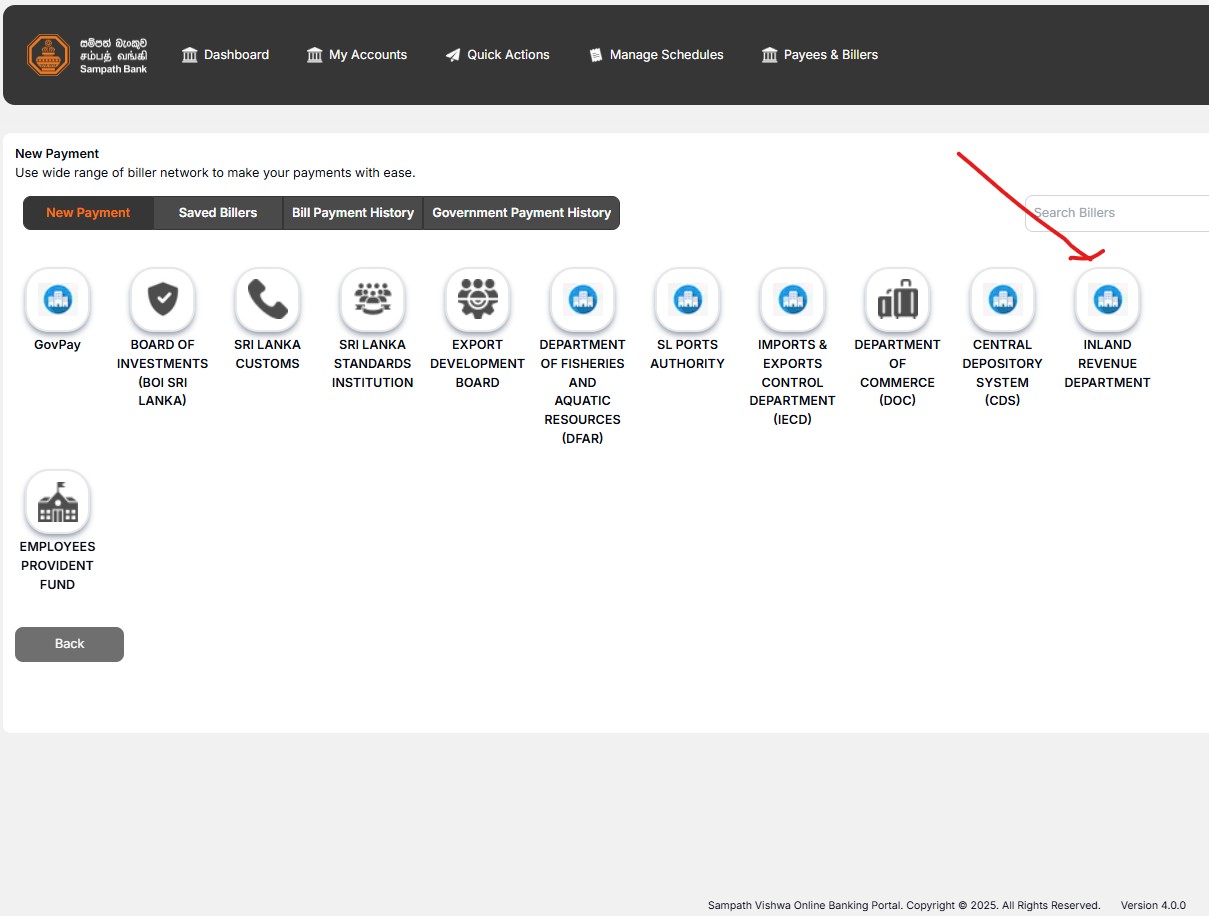

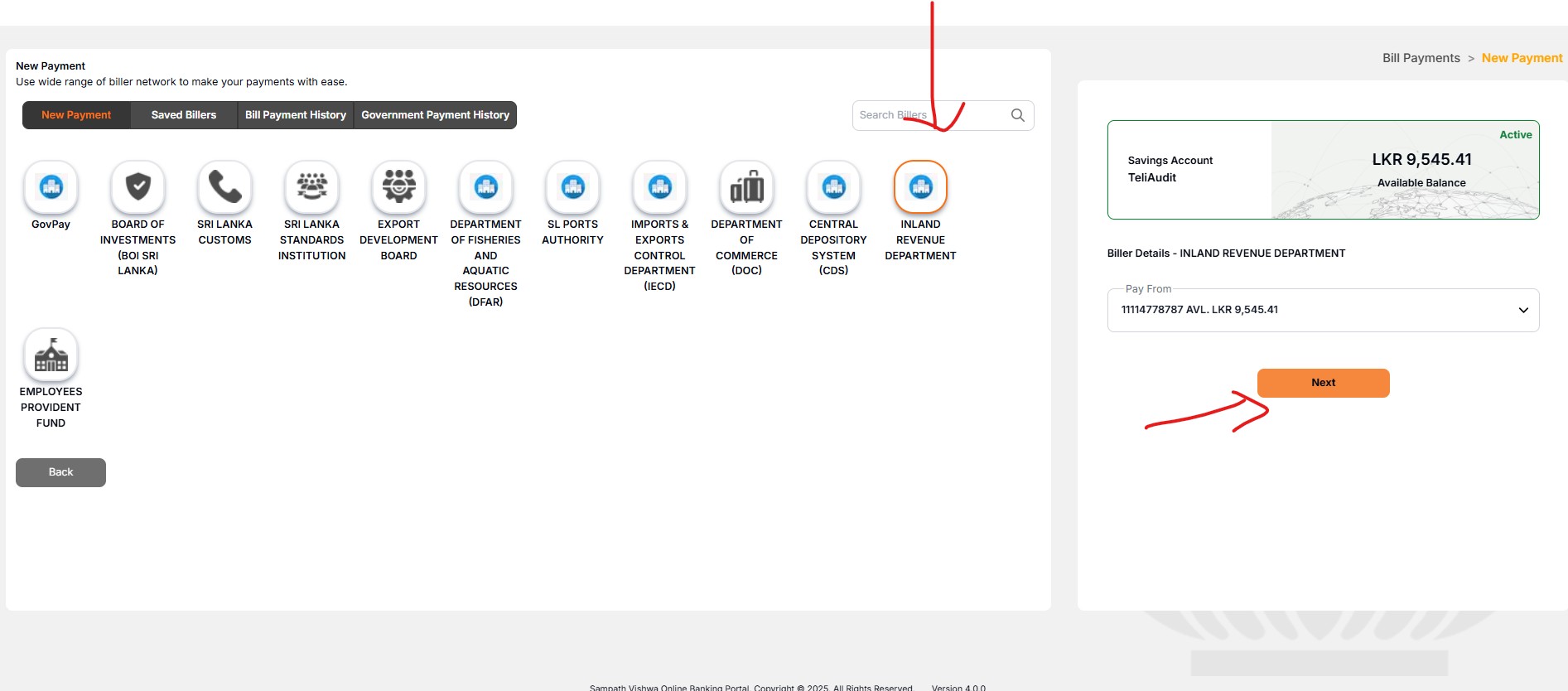

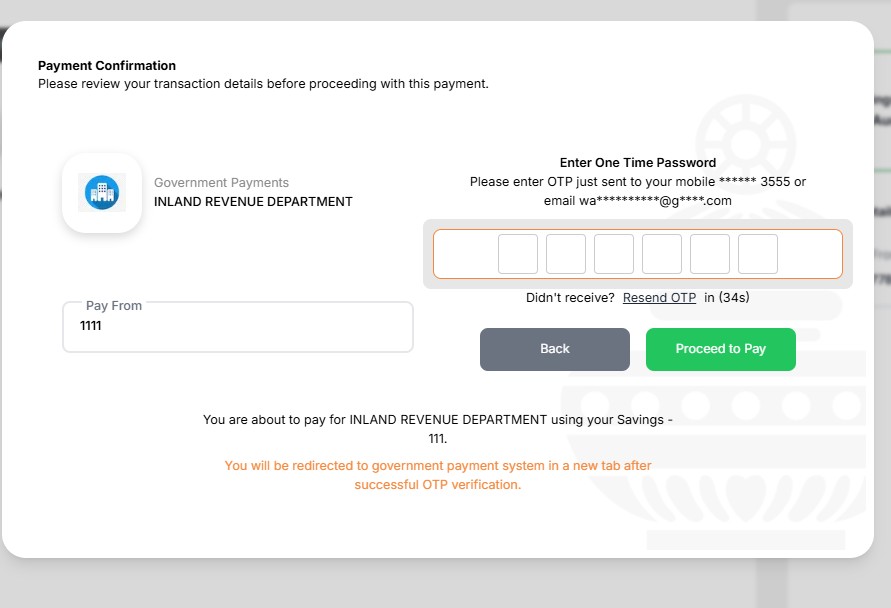

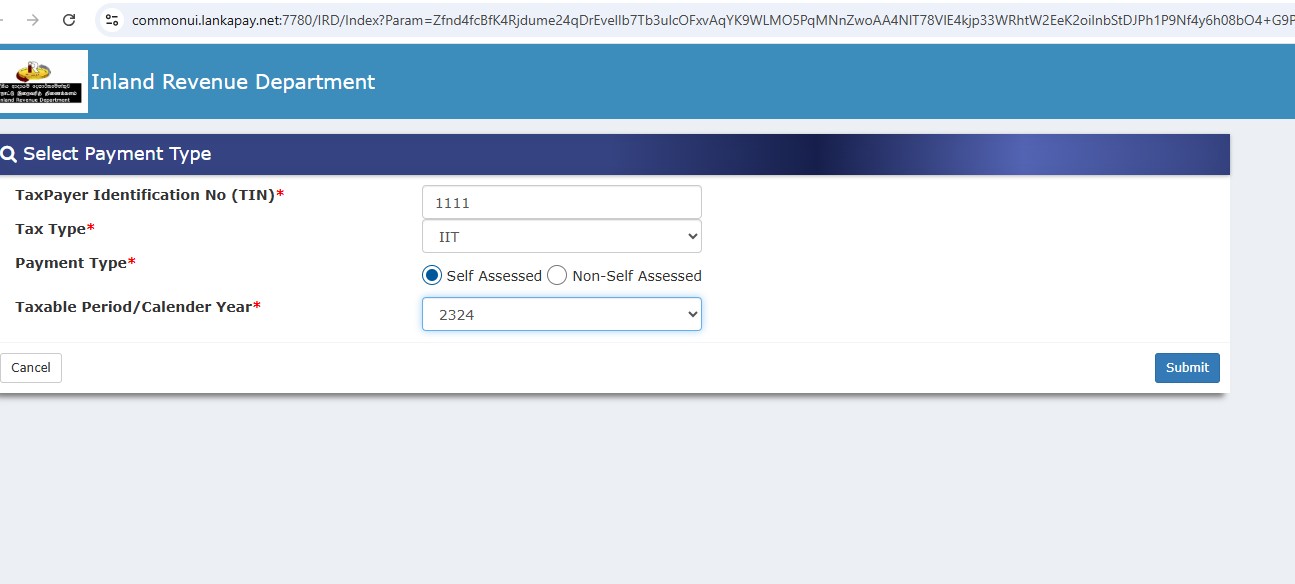

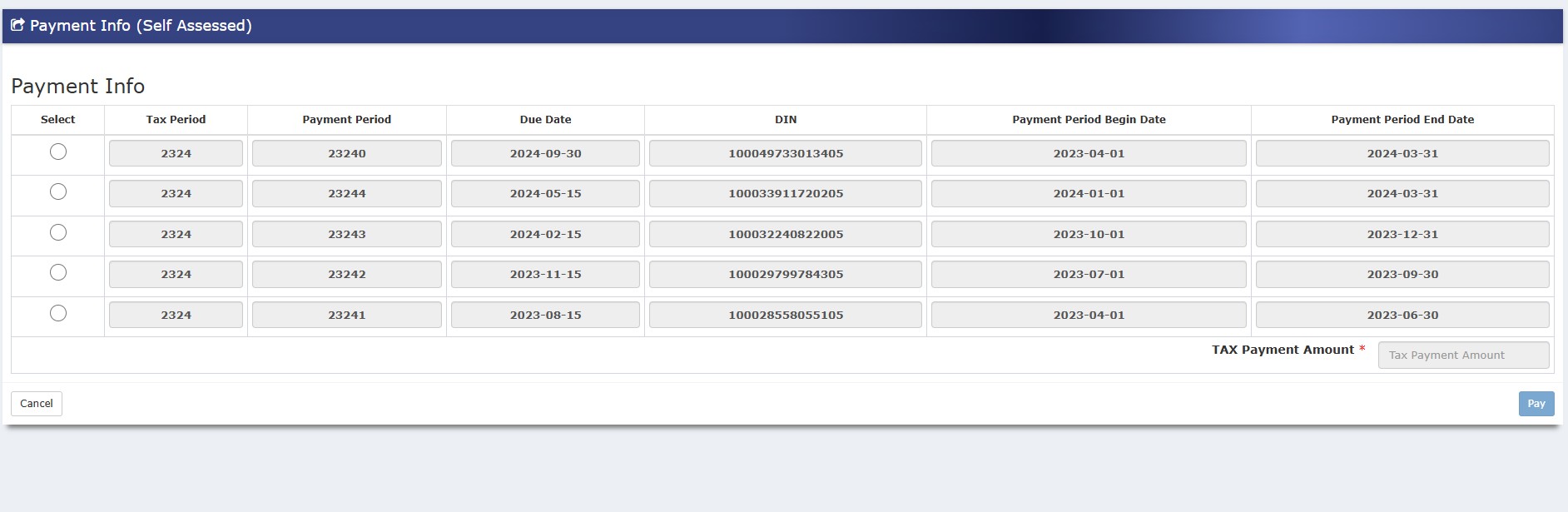

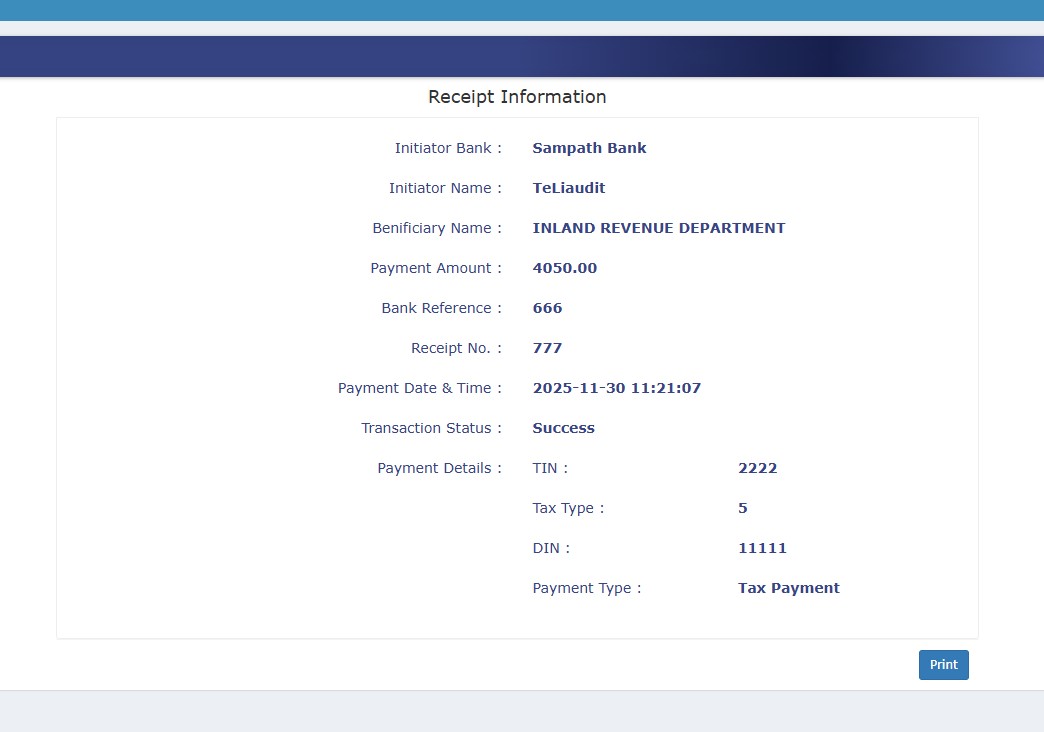

dasun Asked on Aug 22, 2025 12:38Hello can you please guide me to pay via Sampathvishwa

darshana Asked on Aug 22, 2025 12:27admin Dec 02, 2025 02:47

Follow the step below

step01